Offset All or Most of EV Infrastructure Costs

The EV Make Ready Program

- The Electric Vehicle (“EV”) Make Ready Program supports the deployment of electric vehicle infrastructure with a total program budget of $1.243 billion.

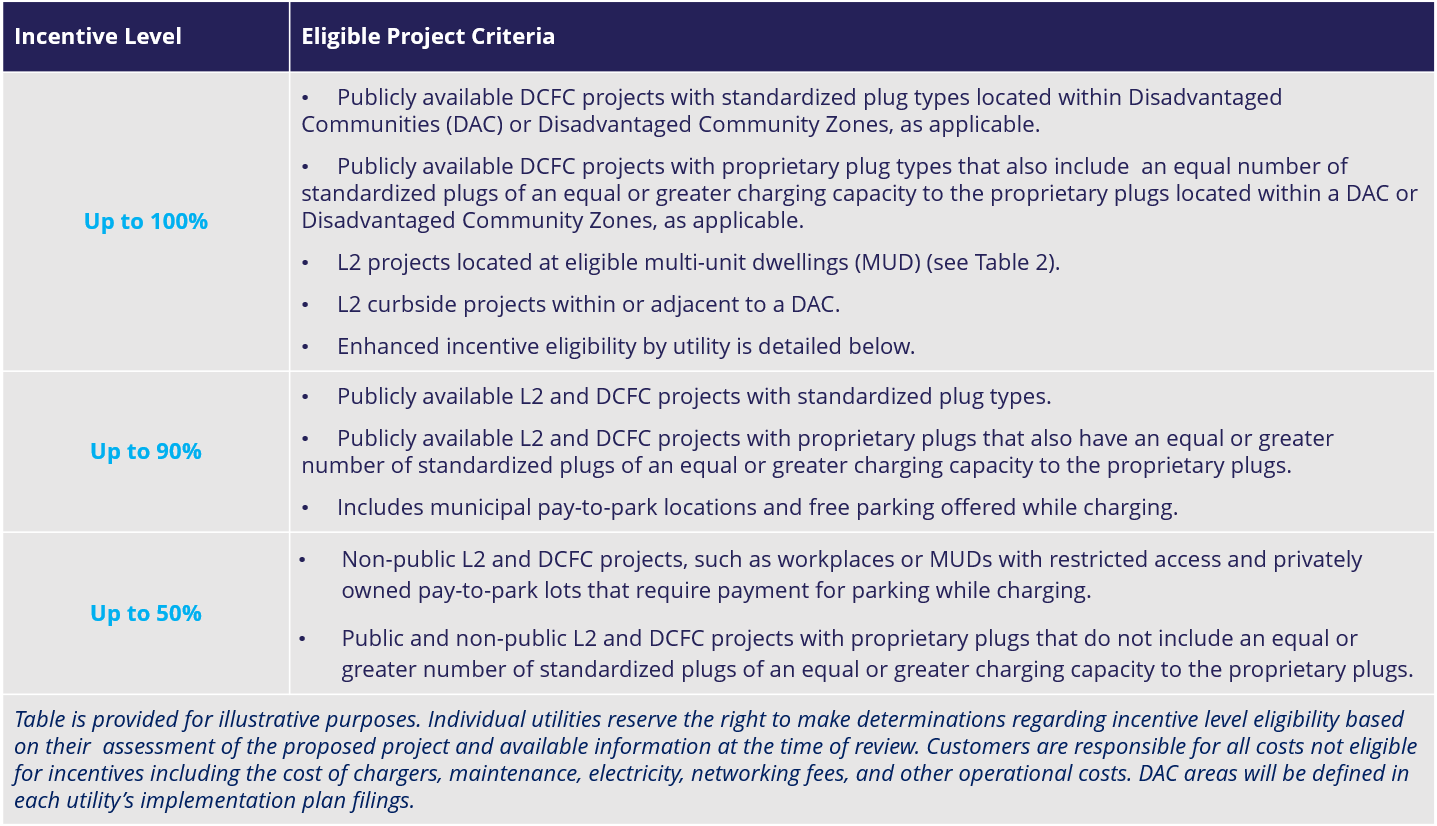

- You can get up to 100% of electric vehicle infrastructure costs covered for non-residential Level 2 (“L2”) and/or Direct Current Fast Charging (“DCFC”) chargers.

- This program will save your municipality time when working with a professional turnkey provider like RTE to take you through the approach step-by-step.

- Ready to get started? Contact us and we’ll walk you through program details, help you submit your application, and streamline the installation of your new EV Charging Stations.

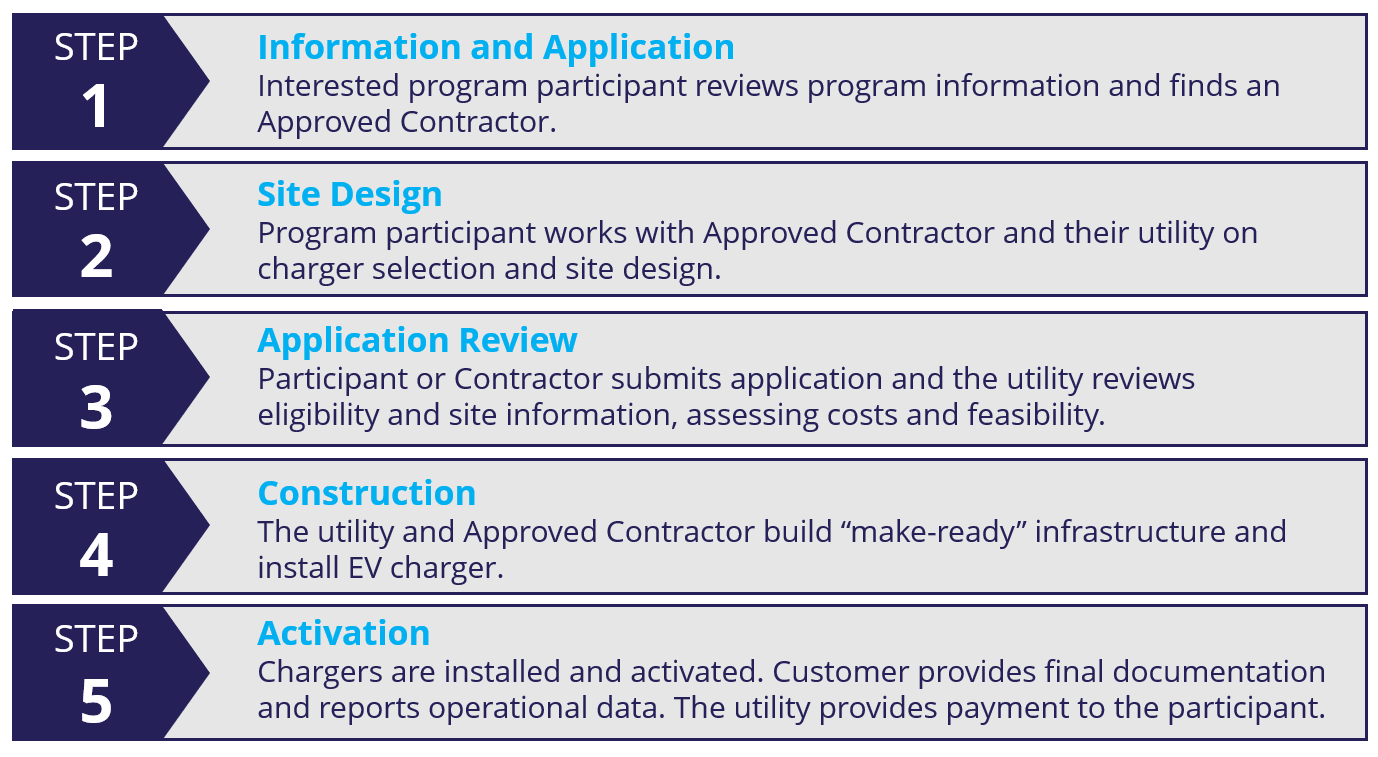

Steps to Participate:

Attract New Customers, Employees, and Tenants at a Fraction of the Cost

Charge Ready NY 2.0

- Approximately $10.8 million in incentives is available for public, private, and non-profit organizations looking to install Level 2 EV Charging Stations through the Charge Ready NY 2.0 Program.

- Workplaces, multi-unit dwellings (MUD’s) or public facilities that are owned and operated by municipal or state government entities are eligible.

- NYSERDA provides incentives on a per-port basis at varying amounts, based on location type and whether or not is it located within a Disadvantaged Community (DAC):

- $4,000 per charging port installed at a public facility (must be located within a DAC)

- $2,000 per charging port installed at a workplace or multi-unit dwelling location.

- An additional incentive of $500 per port may be awarded for eligible charging equipment installed at a workplace or MUD location if located within a DAC. A searchable map of disadvantaged communities in New York State can be found on NYSERDA’s website at https://nyserda.ny.gov/ny/disadvantaged-communities.

- Bonus Incentive Program: The Charge Ready NY 2.0 program will also offer bonus incentives to equipment owners at workplace and MUD locations who complete additional actions to promote EV adoption in their own fleets or with their employees/tenants. Workplace and MUD locations are eligible for bonus incentives of varying amounts depending on workplace/MUD size.

Incentives will be paid upon completion of the installation of charging equipment and the provision of appropriate documentation. Charging stations typically have one or two plugs, or charging ports, per station. Level 2 stations typically provide up to 25 miles of electric range to cars for each hour they are charging.

How the Process Works:

- Select an eligible charging station and network service provider

- Applicants for the Charge Ready 2.0 incentive may be the Equipment Owner or the Installer of the charging equipment on behalf of the Equipment Owner. Charging station applicants can sign up to participate in Charge Ready NY 2.0.

- Pre-Installation Applications: If you are applying before you install your charging station (pre-installation application), you must submit initial documents to NYSERDA. Upon approval, NYSERDA will reserve funds for your project, and you will have 180 days to install your station(s) and submit final documentation. Documents required for pre-installation approval include:

- Post-Installation Applications: If you have installed your charging station within the last 90 days and the installation date is after the Program Effective Date, you can apply and submit all documentation in one submission. Documents required for final approval are listed on page 14 of the Program Implementation Manual [PDF].

- Once the charging stations are completed, all required documentation has been submitted, reviewed, and approved, you will receive your incentive from NYSERDA.

- Charge Ready NY rebates can be combined with the New York State tax credit for installing charging stations. The tax credit is applied after deducting the funding you receive from NYSERDA. Information can be found here

.

. - Equipment Owners may be eligible for Federal tax credits for installing charging stations. Information can be found here

- You can find all program rules in the Charge Ready NY Program Implementation Manual[PDF]. Other documents, forms, and resources can be found under Program Resources.

Get in touch with us to begin! We’ll guide you through program specifics, assist with your application, and simplify the installation of your new EV Charging Stations.